Invoice profit

When entering invoices, the profit you have made on each invoice and invoice line is calculated. You can check this on the View Invoice screen and via the invoice profitability reports.

The profit is the difference between the cost of the line and the revenue received. It is also referred to as the Gross Margin.

Profit is calculated on a line-by-line basis, so profitability figures reflect line discounts, but not invoice discounts.

Note: Credit notes are not included on invoice profitability reports. This is because the cost of a credit note cannot be accurately determined.

Estimated and realised profit

Two profit values are calculated - estimated and realised.

-

Estimated profit is calculated when the invoice is saved.

If you have the correct user permissions, you can change the cost price on the invoice. This amended cost price is only used to calculate the estimated profit

-

Realised profit is calculated when the invoice is posted.

The estimated and realised profit will be different when the cost price of the line has changed between the invoice being saved and being posted.

When the realised profit is not calculated

The realised profit is not calculated if the cost price of the goods is not known. This can occur when a stock item has a negative value. Once the stock level is adjusted, then the realised profit on the invoice is updated.

See How the cost price is calculated.

Profit calculation method

The profit percentage is calculated using:

- The Sale value for each line. This is the selling price multiplied by the line quantity.

- The Cost value for each line. This is the cost price multiplied by line quantity.

You decide how you want this percentage profit to be calculated on the Stock Control Settings | Options tab:

-

A percentage of revenue.

100 * (sale value - cost value) / (sale value)

-

A percentage of cost.

100 * (sale value - cost value) / (cost value)

You sell 5 items with a cost price of £10 each (£50) and a sale price of £15 each (£75).

| Profit calculation method | Profit |

|---|---|

| Percentage of revenue | 100 * (75 - 50) / 75 = 33% |

| Percentage of cost | 100 * (75 - 50) / 50 = 50% |

How the cost price is calculated

Free text lines

A notional cost price can be entered with each free text line. To do this, edit the line and enter the required cost price.

This cost price is used to calculate both the estimated and realised profit.

Additional charge lines

A notional cost price can be set on each additional charge record or can be entered with each charge line. To do this, edit the line and enter required cost price.

This cost price is used to calculate both the estimated and realised profit.

Invoice and order items

A notional cost price can be set of each item record. This can be changed when the item is added to an invoice. To do this, edit the line and enter the required cost price.

This cost price is used to calculate both the estimated and realised profit.

Stock items

This depends the costing method used for the stock item.

-

FIFO.

-

Estimated profit: Uses the average cost price, unless the cost price is changed on the invoice. Then the amended cost price is used.

-

Realised profit: Uses the earliest price paid for the stock items divided by the number of items.

Example of FIFO-

You buy ten items at £10 each.

-

You buy an additional five items at £15 each.

-

You now have 15 items in stock.

-

You sell seven items.

The estimated unit cost is 11.67. This is the average cost price of all the items bought so far: ((10 items x £10) + (5 items x £15)) / 15.

The realised unit cost is £10. This is earliest price paid for the goods divided by the number of goods: (7 items x £10) / 7.

-

You sell the remaining eight items.

The estimated unit cost is £11.67. The average cost price hasn't changed as you haven't bought any more items.

The realised unit cost is £13.12: ((3 items x £10) + (5 items x £15)) / 8.

-

-

Standard: The cost price specified on the stock item record.

-

Average: The current average cost price.

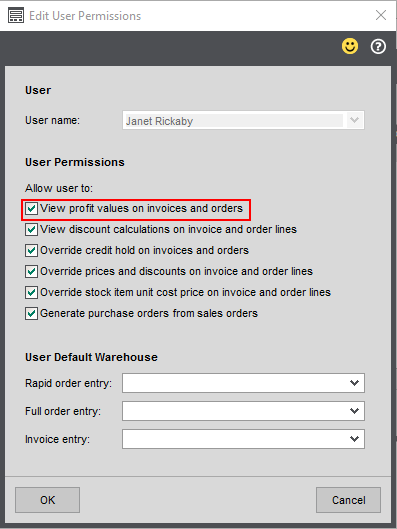

Control who can see the profit

You may not want all your staff to see the profit made on each invoice or invoice line. The invoice profit can be seen on the View Invoice screen and via the invoice profitability reports.

-

You can choose which users have access to the profit buttons on the View invoice screen. You set this is on the User Permissions screen.

Open: Settings > Invoicing and Sales Orders > User Permissions.

The Administrator user can see the profit automatically, but you'll need to turn it on for any other users. See Invoice and order user permissions.

-

You can control who can access the profitability reports, using the User Access screen.

Open: Settings > Organisational and Financial > User Access

-

Find the reports in Invoicing > Reporting, and select Invoicing Profitability (Detailed) and Invoicing Profitability (Summary).

-